First, the dashboard combines multiple sources of data to provide a complete and accurate financial picture. This way, they spend more time identifying ways to reduce costs and increase profitability and less time preparing data as they do with spreadsheets. Visibility into your key accounting metrics and data are critical to running your business. Waiting on multiple financial reports is a headache; a real-time accounting dashboard aggregates all your accounting and finance metrics in one place. In this accounting dashboard example, we get a real-time view of invoices, cash flow, accounts receivable and accounts payable, profit and loss, and much more. The idea behind the Xero accounting dashboard is to keep business owners, bookkeepers, and accountants aware of what is happening in the business at all times.

To keep your reports looking the same, you may also use pre-made themes or make your own custom themes. Determine your target audience as well as the important metrics and insights you wish to share. Spreadsheets, databases, internet services, and other data repositories can all be examples of this. This powerful financial dashboard is a full featured options price calculator with functions such as Black and Schole available in the charts.

The net value of fixed assets metric lets you make better decisions about how to use your long-term assets. This financial dashboard template reveals asset value, now and historically, along with depreciation. It can help your team make better decisions about when to modernize your assets or when to replace them, or repurpose them. Slicers, filters, and drill-throughs are some of the capabilities that can improve the interactivity of your Power BI dashboard. These let each user investigate the information and find insights according to their own needs. Applying formatting options, what is cash flow such as fonts, colors, backdrops, and layouts, will help your dashboard look more appealing.

How Can Financial Dashboards Help Make Business Decisions?

The gap between searching for those insights and actually getting them leaves managers with very little time, and a lot of headaches, to drive meaningful change in their businesses. AI analytics refers to the use of machine learning to automate processes, analyze data, derive insights, and make predictions or recommendations. It’s important to note that these are just general categories, and many dashboards can combine elements from multiple types.

- Color-coded charts provide at-a-glance understanding of utilization and exposure by region, industry and customer.

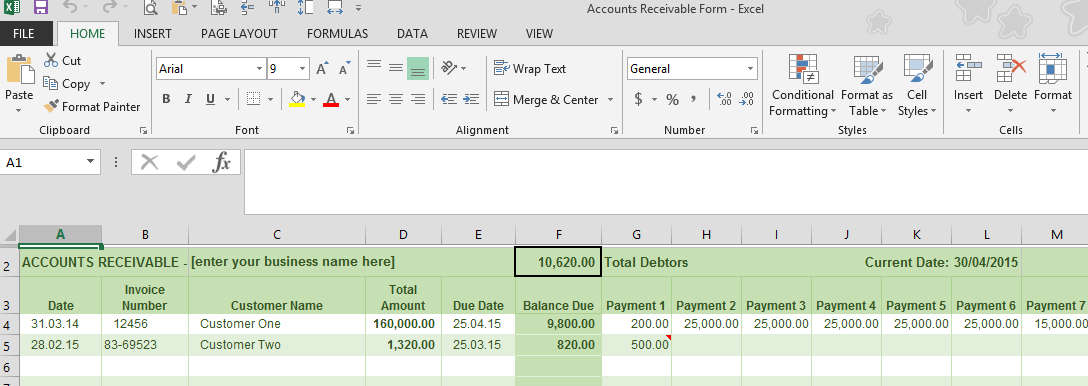

- In this accounting dashboard example, we get a real-time view of invoices, cash flow, accounts receivable and accounts payable, profit and loss, and much more.

- An accounting dashboard is a centralized platform that tracks your business’s real-time financial performance.

- However, it’s best to separate this data on different pages using Ajelix BI.

- Along with projected revenue, accounting dashboards that predict your future payables can help you understand your company’s current bandwidth.

Accounting Seed Sponsors Dreamforce 2024, Following Major Product Launches, and Inc. 5000 Recognition

With the right financial reporting dashboards in place — such as revenue dashboards or general ledger dashboards — CFOs and their teams can track business-driving KPIs in real time. This up-to-the-minute tracking makes it easier to respond to changes in the business environment and take advantage of emerging opportunities. Finance professionals need to quickly understand how actual expenses compare to forecast for a given time period and trending over time for each expense type.

Try what is a debit and credit bookkeeping basics explained out all the features of Bold BI with 15-day free trial and get to know how it suit to your needs of embedded analytics. Sign up for free and start making decisions for your business with confidence.

Key Features and Benefits

This payables aging finance dashboard example surfaces pending and overdue payments. It can also help you cut costs by lowering your interest payments as you take advantage of low-interest or no-interest payment dates. You can choose from current or historical views to track improvements and gain insights into managing your payables map. With the right corporate finance dashboards in place, you’ll see revenue, costs, profit, loss, and all your other guiding stars laid out at your fingertips.

Average Days to Pay By Customer

By entering different input values, financial analysts can quickly see the relationship between volatility and option price and get values for option delta, vega, rho and theta. Connect to hundreds of services and APIs directly and build highly customizable dashboards and reports for your team and clients. Connect to your warehouse, semantic layer, and hundreds of service quickbooks vs excel for small business APIs to put data analysis and dashboards into the hands of business users. Let us know what you are trying to build and our team of experts will help you turn your data into actionable insights.

A project-net-profit dashboard helps to highlight the profitability of each active project. That added clarity can spotlight the projects that deserve more resources and the ones that need attention. The right dashboards give your team the power to spot trends, opportunities, and growing problems, and effortlessly visualize large datasets.

Check the specific features of your chosen tool to determine the integration process. Build a custom dashboard to track accounting key performance indicators, optimize business operations, and fuel growth. In conclusion, online accounting dashboards are indispensable tools for modern accountants.